The SMMT new car registration data confirms that the new car market has experienced an exceptional level of activity over the past few weeks with figures up by 23.1% over the same period last year. It would be fabulous to think that this surge in registrations was due to a significant change in consumer demand driven by confidence in the economy or outstanding demand for cost-effective new cars. Unfortunately, this is not the case although this unseasonal boost has brought the year to date market performance to a 4.2% deficit over the volume of cars registered by this point in 2017.

The reality is that August registrations have been boosted by the introduction of the new WLTP regulations that came into place at the beginning of September which effectively meant that large volumes of cars that could only meet the outgoing NEDC legislation needed to be registered before the August 31st cut off. This has resulted in some unprecedented new car deals being offered in an attempt to sell stock to retail consumers. However, it has also meant that there has been a significant increase in pre-registration activity.

As a result, the detail of the market changes could be seen as largely irrelevant as it is so distorted. Looking at diesel car registration data demonstrates the level of potential inaccuracy with a decline in volume of 7.7% over August 2017. Compare this to the year to date drop in diesel registrations of 28.7% and it is clear that something is not right, although the market share for the month at 29.7% is 10% lower than in 2017 which is more in line with the 11.1% decline measured year to date in 2018.

Petrol powered registrations for the month have improved by 39.1% which is notable to say the least but not as large as the 88.7% increase in registrations for Alternative Fuel vehicles. With figures that appear to be so inflated, the need for detailed new car market analysis has never been greater. It will be fascinating to see what happens to registrations during the usually key month of September although indications are that new car supply has been disrupted and focus may well be on moving the quantity of pre-registered vehicles now sitting in the used car market. The remainder of the year is likely to be hard to forecast and will bring challenges to some new car franchises.

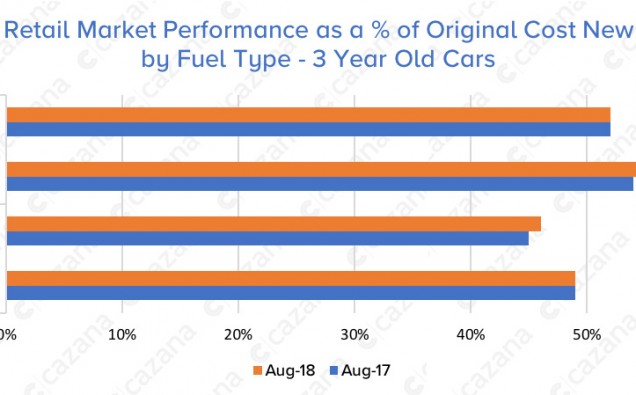

With such a difficult trading period in the new car market unfolding day by day, and set to be the case for the remainder of 2018, many businesses will be looking to the used car market to bring stability and more importantly profit to their bottom line. Reviewing the Cazana data collated daily over the past month shows that the used car market has slowed slightly although this should come as no surprise given that August is a key holiday month for much of the British population and with such favourable weather conditions traffic at the dealerships and more importantly online has been slower than many would have liked.